We’re never too young to begin laying the groundwork for a successful future. Now is the time to make our dreams a reality, whether we are just beginning our careers or working for our next big break.

How Can I Get Rich In 5 Years?

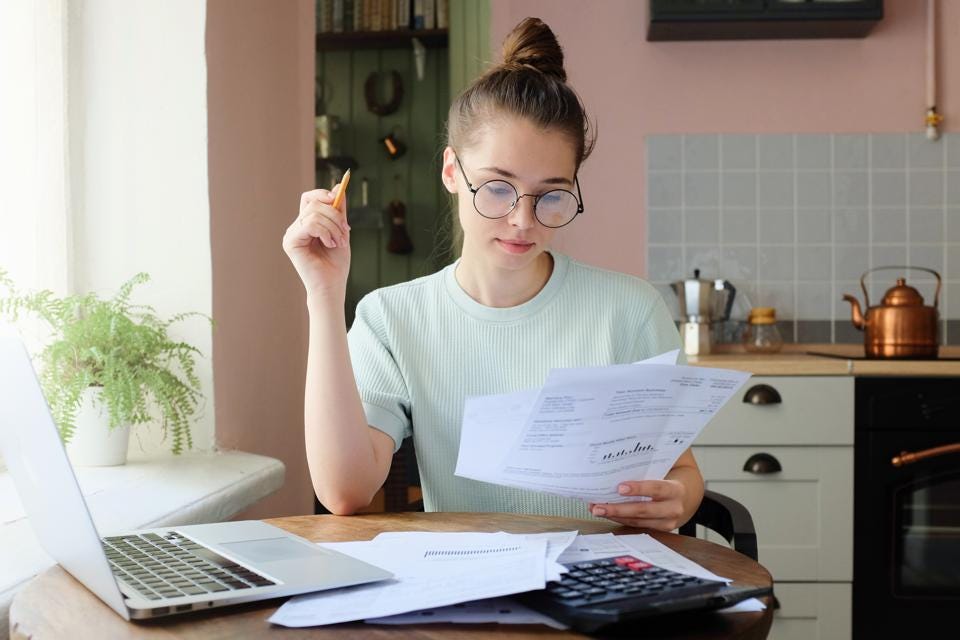

Know Where Our Money Is Going

The first step in creating a sound financial strategy is understanding where our money is going. It might be difficult to make better financial decisions if we don’t know where our money is going.

Understanding where we allocate our money is the best bet for financial success.

Financially Educate Ourselves

The lack of formal education and training in finance is under-recognized. Many individuals only learn how to handle money in financially difficult circumstances, which shouldn’t be the case. Financial literacy is among the cornerstones of becoming financially independent.

Pay Down Debt

The next step is to actively pay off debt when we have figured out where our money is going. Borrowed money can harm our lives in numerous circumstances.

10 Ways To Become Rich From Nothing

Universally, people want wealth. However, it seems impossible if we are barely getting by. After all, “we need money to earn money.” We may assume we can’t build significant wealth if we don’t have money.

But that’s not entirely true. Even with little money, we can build wealth over time. It won’t be easy, however. To become self-made millionaires, we must at least begin with something.

It is unhealthy to compare ourselves with others. Doing so will make us feel more defeated, and we haven’t even started yet. Focus on our own money; before we know it, building wealth might not be that hard after all.

1. Get Our Money Mindset Right

Our money mindset is a significant part of our journey to becoming rich. If we have a bad attitude, we’ll make terrible financial judgments and remain poor. We can improve our mentality by creating good habits.

A financial vision board is a proven way to become inspired and develop a wealthy attitude. Placing it where we can see it daily might keep us motivated.

Another technique to improve our money mindset to become rich is to read success stories. When others succeed, it might drive us to achieve financial success.

2. Save

Saving money is essential for being wealthy. We can save even on a small budget. There are several strategies to save money quickly. Although we can’t trust our entire life on our savings, it is still a significant part of getting rich.

3. Enhance Our Current Income

We can get rich by increasing our revenue. One way to do it is by asking for a raise. But before doing it, we should have a good work record and be long-time employees. If we’re excellent workers, they may raise our salaries to prevent us from leaving.

Getting more schooling may help us acquire a better-paying career. Consider a trades job as an alternative to a student loan. Trade career programs are cheaper and faster than universities.

4. Spend Intentionally And Minimize Costs

Cutting our expenditures and spending wisely is one way to become rich. Budgeting can help us with minimizing our costs and spending intentionally.

This way, we can monitor our spending and prioritize where we will spend our money. This covers debt reduction, savings, entertainment, and emergencies.

Minimize expenditures so we can invest more money in building wealth.

5. Plan For The Long-Term

Retirement planning as early as possible is important. We should start saving early to take advantage of compound interest. We should also have an emergency fund to avert excessive debt if the worst comes. By saving long-term, we’ll have a nest egg beyond our 30s.

6. Take Risks

If we want to be wealthy, we must be willing to take risks and accept the fact that the only sure way to success is through uncertainty.

Taking the safest route, such as getting a regular job with a set salary, may lead to financial security, but wealth is generally earned by taking calculated risks.

7. Create Multiple Income Streams

Putting all our revenue in one basket is bad advice. Wealthy people have seven sources of income. Why? Because diversifying our income will help build financial security and wealth quicker.

A side gig with our day job may offer two revenue streams. Our side gig will provide us extra money even if we lose our job.

Main job, side employment, passive income, investment accounts, savings account interest, and rental properties are income sources. Diversification is one way to become rich and let money work for us.

It’s not enough to have enough money for a year or two; we need a steady income to stay rich for decades.

8. Start A Business

Establishing a business can make us wealthy if done right. We can use the skills and knowledge learned from our side jobs to establish a business. Establishing a new business might seem scary, but the benefits outweigh the risks.

9. Invest Wisely

The first guideline of financial freedom is to save money; however, it’s not all that reliable. Why? Because inflation will eventually defeat us, and our money won’t be as valuable in 5 or 10 years.

Investing is key to being wealthy. We can invest to build wealth and net worth regardless of our financial status.

Investing early builds money faster. Although being wary of the volatility of the stock market is reasonable, it should not hinder us from investing. After all, we can learn everything we need to start investing.

10. Find Good Mentors

Risk and difficulties are necessary for success and prosperity. A mentor to guide us through our journey is priceless. A good mentor may provide guidance and be a sounding board in difficult situations. They can help us look beyond ourselves since they’ve been in our shoes. Audience insights also help us improve.

Final Thoughts

Almost everyone’s ultimate ambition in life is financial success. Even if we’re living paycheck to paycheck, we may still accumulate money and become wealthy. We can attain our financial objectives, accumulate money, and ultimately become wealthy if we follow the tips outlined in this article.